This website uses cookies to facilitate navigation, registration and collection of statistics. The information stored in cookies is used exclusively by our website. When browsing with active cookies consents to its use.

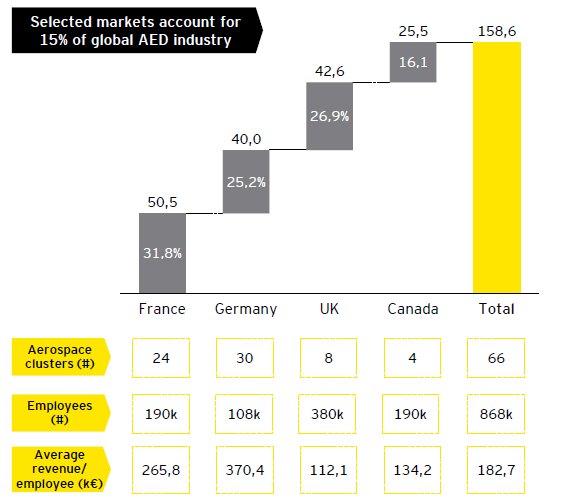

| The four selected markets cover circa 15% of the total ASD global and are represented by 66 industry-specific clusters |

Revenues for the ASD key markets [€bn, 2017]

| ASD players are redefining their strategies to address national and global pressures which are shaping the ASD industry dynamics |

FRANCE

- Highly mature industry with multiple Tier 1 companies operating in the supply chain (highly competitive market)

- Airbus diversifying customer base with the qualification of both European and non-European suppliers (e.g. <10 from Portugal)

GERMANY

- Tier 1 expected to be fully responsible for complete modules instead of OEMs, due to strong collaboration trend (e.g., risk-sharing partnership)

- Strong collaborative environment between industry and R&D institutions, resulting from 30 AED clusters operating together

UK

- Government increasing funding in the Aeronautics and Space sectors making use of the Defense budget

- Lower than average revenue per employee due to high level of local sourcing along the supply chain (including raw materials and MRO)

CANADA

- Easy access to European OEMs’ deals due to a free trade agreement that cuts 98% of the Canada’s current tariffs

- Government focuses in new aircraft pilot training due to aircraft demand growth and expected national shortage of aircrafts