This website uses cookies to facilitate navigation, registration and collection of statistics. The information stored in cookies is used exclusively by our website. When browsing with active cookies consents to its use.

The French industry is highly focused on the Defense sector, with the country being the only self-sufficient Defense market in Europe

French ASD industry overview

2012-17 CAGR

2012-17 CAGR

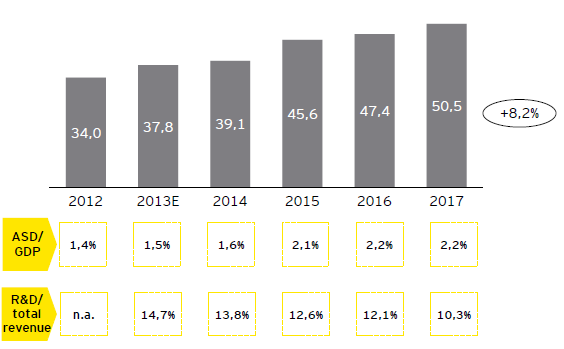

| The French ASD industry grew by 8,2%/ year, reflecting an increase of 0,8 pp in % GDP (2012-17) |

French ASD consolidated revenues [€bn, 2012-17]

- The ASD industry weight in the countries’ GDP has been increasing, largely due to growth in Defense and Aeronautics

- However, the percentage of R&D investment over total industry revenues is decreasing, which may result in future loss of competitiveness

| Increasing air traffic and pressure from NATO to meet the 2% GDP target are the main drivers for continuing growth |

Aeronautics

- France increasing vertical specialization in Aeronautics has already led the sector to have a 130% higher weight in total exports than the average (1) of peer markets

- The sector has benefited from strong growth in air traffic, resulting in higher sales of civilian aircrafts and airlines’ maintenance

Space

- The Space industry has been growing steadily, also leveraging the integration of Ariane 6 (a Spacecraft launcher) in the Airbus Safran Launchers supply chain

- Positive outlook with more contracts to develop satellites parts with EU markets (e.g., multi-million Airbus deal with Eutelsat in 2018)

Defense

- Expected growth in Defense expenditures with NATO’s 2,0% GDP target is leading to an increase manufacturing capacity and military personnel

- With €4,1bn military sales in 2017, France plans to invest €1bn per year in R&D until 2022 as part of government’s drive to encourage innovation

Note: (1) Comparative analysis between France, US, United Kingdom, German, Canada, and Italy

Sources: Ministry of France and Foreign Affairs, Statista, AIN Online, Safran, Oliver Wyman, Mergent, GIFAS, EY analysis

Tier 1 players key system exports, while lower Tiers focus on supplying the domestic market

French ASD industry: market breakdown

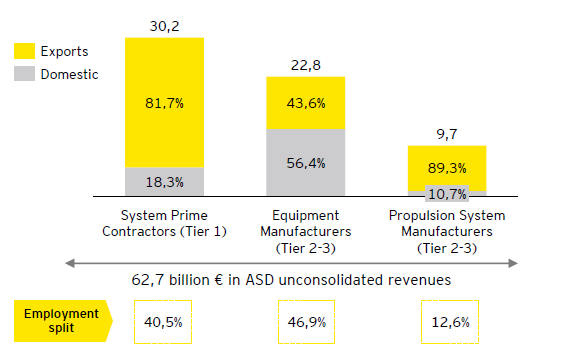

| More than half of total ASD revenues come from Tier 1 companies, which reflects a market focused on high value-added activities |

French ASD sales breakdown by value chain segment, destination market and employment [€bn, %, 2017]

- Over 80% of Tier 1 players manufacturing products is exported, which reveals potential for supply chain improvement in this segment

- Tiers 2 and 3 focus in domestic market since most of its activities feed the local demand of OEMs and Tier 1 players

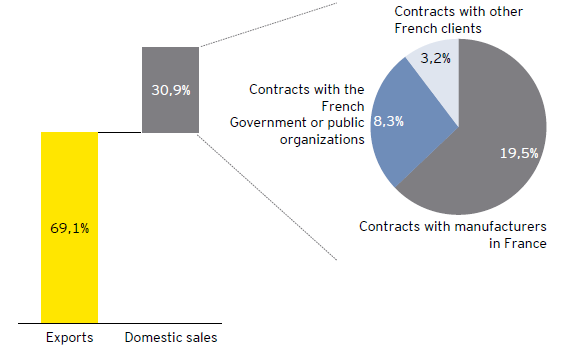

| The French ASD industry is mostly focused on exports, despite strong domestic demand |

French ASD market mix as % of consolidated revenues [%, 2017]

- In 2017, French exports accounted for the greatest proportion of unconsolidated revenues (69,1%) mainly due to increasing aircraft orders

- More than half of French ASD exports are for European and North American markets

Sources: GIFAS, EY analysis