This website uses cookies to facilitate navigation, registration and collection of statistics. The information stored in cookies is used exclusively by our website. When browsing with active cookies consents to its use.

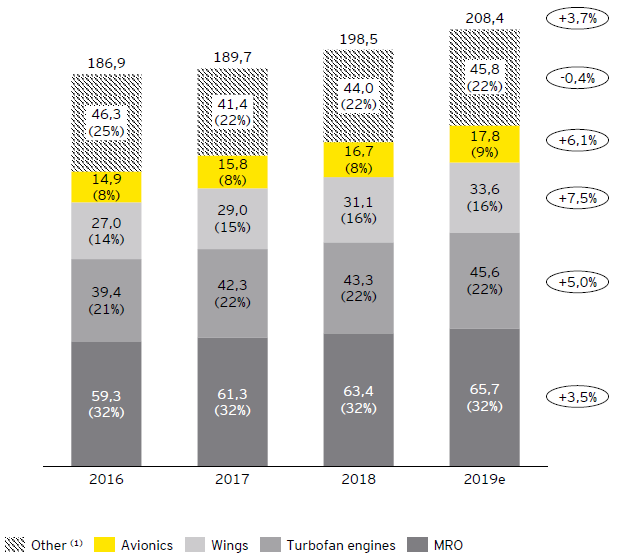

The global commercial aircraft manufacturing market is expected to growth 3,7% CAGR since 2016, reaching €208 billion in 2019

Global Aeronautics industry: market value growth

2016-19 CAGR

2016-19 CAGR

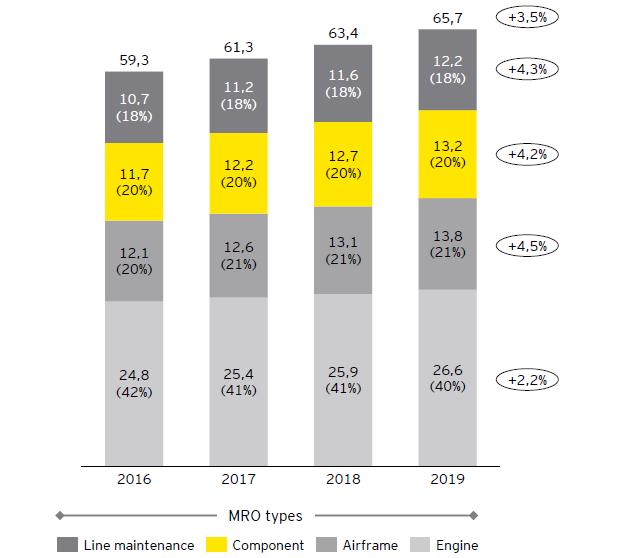

Global commercial aircraft manufacturing and MRO market value (billion euros, 2016-19)

Global commercial aircraft MRO market by MRO type (billion euros, 2016-19)

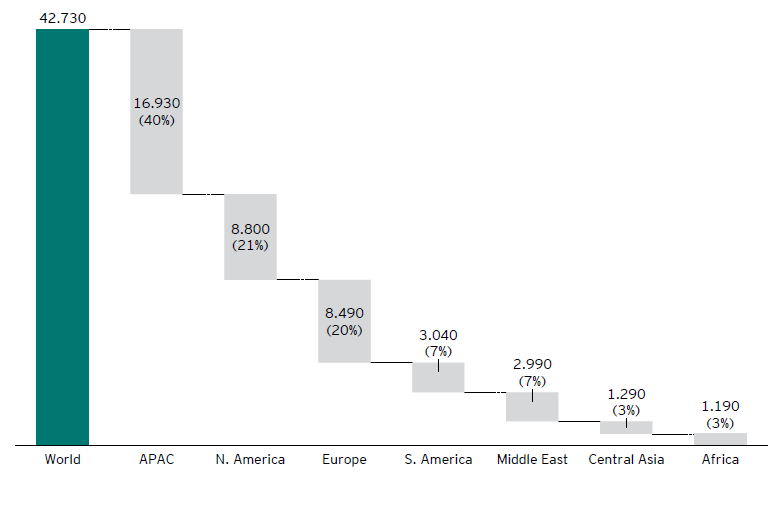

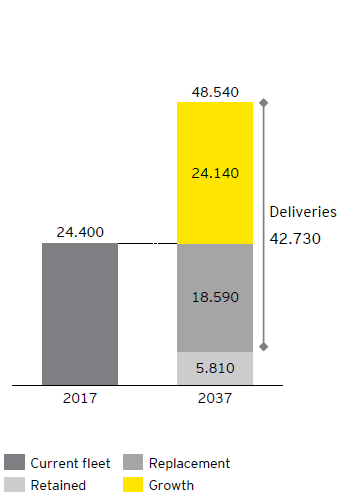

More than 42 thousand deliveries will be needed to meet aircraft demand for the next 20 years, both for growth and replacement

Global Aeronautics industry: expected demand evolution by geography

| Almost 40% of planned commercial aircraft production by 2037 is to be delivered to the Asia-Pacific region, as much as Europe and North America together |

| Of the 42.730 aircraft to be produced by 2037, 43% will be replacements |

Planned commercial aircraft deliveries per market (number of aircraft and %, 2018-37)

Global commercial aircraft capacity forecast (number of aircraft, 2017-37)

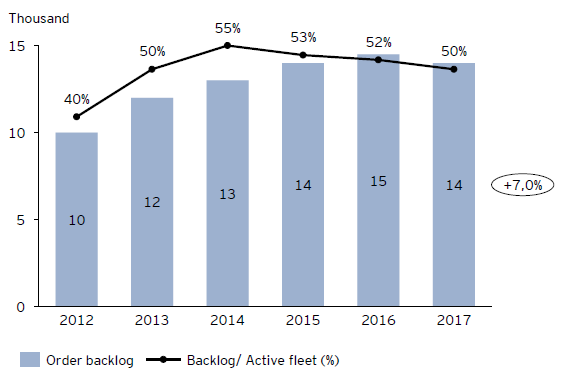

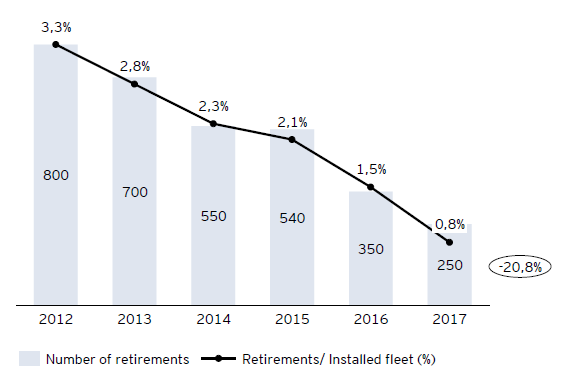

The current global backlog for commercial aircraft is almost half of the total active fleet, and grew 7% per year in 2012-17

Aeronautics sector: overview of OEM production backlog and retirement rate

| Commercial aircraft OEM production backlog is forecasted to remain at historical highs |

| Aircraft retirement is decreasing by 20,8% per year since 2012, mainly due to lower fuel costs and significant order backlog |

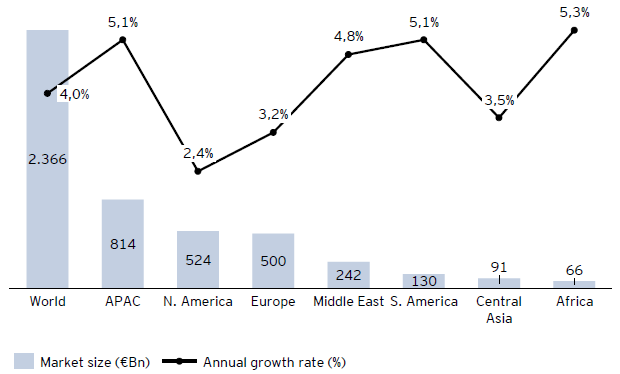

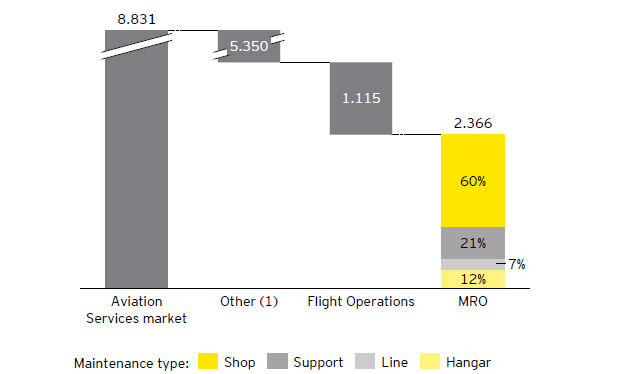

The global MRO market is expected to grow by 4% until 2037, accompanying low retirement rates and higher in-service times

Aeronautics sector: overview of commercial aviation services forecasted market

| By 2037, the gap between MRO growth rates in APAC and North America/ Europe will more than double |

| The commercial aviation services market is expected to reach €8,8 trillion by 2037 |

Note: (1) Includes Ground, Station and Cargo Operations, Marketing, Planning and Customer Service, and Corporate and External services

Sources: Boeing, EY analysis

Supply chain reorganization and digital transformation are major Aeronautics-specific trends

Aeronautics sector: snapshot of main industry trends

![]()

Global partnerships

Global players are partnering with emerging markets players for integration with the global supply chain (e.g., intellectual property, data services)

![]()

Pursuing localization in international markets

Local partnerships, developing local supplier-networks and opening new facilities to pursuit presence in international markets

![]()

Improving the supply chain

Companies are pursuing vertical integration to reduce operating costs by eliminating supplier margin and improving agility to address market requests

![]()

Market consolidation and M&A

APAC is expected to have high growth, driven by increasing investments of China and India in developing commercial and military drones

![]()

Focus on after-market services

Companies are restricting intellectual property and licenses for component manufacturers and acquiring or forming partnerships with MROs

![]()

Adoption of digital technologies

Aeronautics players are applying digital solutions to improve service life-cycles (e.g., using data to improve performance and aircraft health monitoring)

![]()

Focus on improving productivity and cost efficiencies

Companies are adopting strategies of smart contracts and additive manufacturing to improve production efficiency and lead times

France, Germany and the UK are the key European markets, with Canada assuming a particular role as a non-European market

Read more