This website uses cookies to facilitate navigation, registration and collection of statistics. The information stored in cookies is used exclusively by our website. When browsing with active cookies consents to its use.

The German ASD industry shows positive growth since 2012, with the presence of a global aircraft OEM in its ecosystem a major driver

German ASD industry overview

2012-17 CAGR

2012-17 CAGR

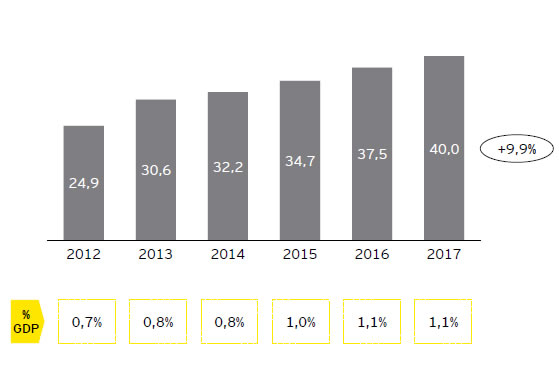

| The German ASD industry grew by 9,9%/ year, reflecting an increase of 0,4 pp in % GDP (2012-17) |

GermanASD revenues[€bn, 2012-17]

- The Aeronautics sector represents 73%of total ASD industry revenues. In contrast, the low weight of Defense revenues show that it is not a sector of focus in the German market

- In 2017, the ASD industry spent more than 10% of its revenues in R&D (4 billion €), and the number of employees rose 30% since in 2007

| Increasing aircraft backlog and defense spending are the main drivers for continuing growth |

Aeronautics

- The supply chain, with a growth of8,5% on 2014-15, is leading the ramp-up of civil aircraft sector, as SMEs are winning contracts with non-EU aircraft manufacturers (e.g., Boeing)

- Besides the 35k new aircrafts forecasted for the next 20 years, German market demandis expected to grow due to the need to replace 15k units in the next years

Space

- Increasing focus in the Space sector led by launching the Europe’s Galileo navigation system with in Germany’s currently support in the production of 12 new satellites for the 2020

- Expected Tier 1 Space suppliers being fully responsible for complete modules instead of OEMs by 2020 due to market consolidation

Defense

- The Defense budget has increased and is expected to grow at a 5% CAGR (2018-22) due to military-IT networks, frigates, and transport aircraft government investments

- Forecasting €60bn in Defense funding by 2024, also due to Germany’s role as a NATO’s framework nation in its Very High Readiness Joint Task Force

Sources: USA Government, AeroDynamic Advisor, Mergent, BDLI, ITA, Federal Ministry for Economic Affairs and Energy, GTAI, Airbus, EY analysis

Germany is mostly an Aeronautics-focused market, with residual weight of the Defense sector

German ASD industry: market breakdown by destination, sector and value chain segment

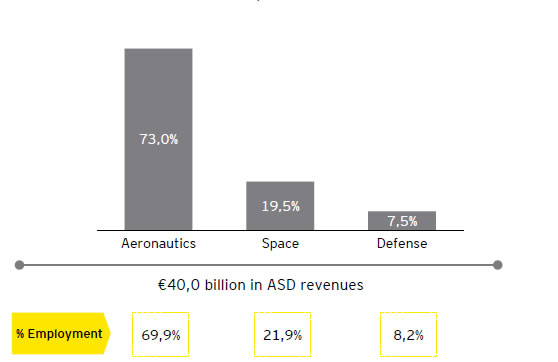

| In 2017, the Aeronautics sector represented 73% of the total ASD German market revenues |

German ASD revenues breakdown by sector [%, 2017]

- The Aeronautics sector represents 73%of total ASD industry revenues. In contrast, the low weight of Defense revenues show that it is not a sector of focus in the German market

- In 2017, the ASD industry spent more than 10% of its revenues in R&D (4 billion €), and the number of employees rose 30% since in 2007

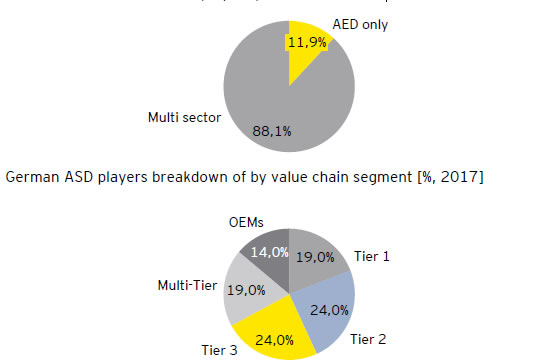

| Only 12% of German ASD players supply exclusively the ASD industry, which shows a low level of specialization on the supply chain |

Distribution of German ASD players portfolio [%, 2017]

- Due to ASD being considered a niche industry in Germany, most players opt to diversify, mostly for the machine building and automotive sectors

- Almost half of the German market is composed by Tier 2 and Tier 3 players, but the trend is for market consolidation on these segments

Sources: BDLI, ASD, EY analysis